Invest

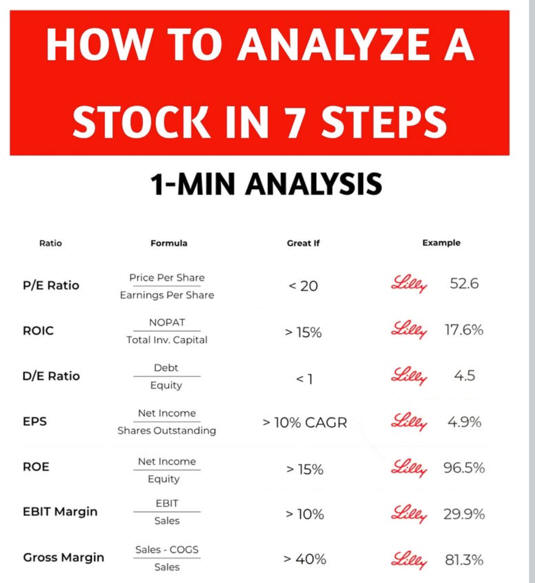

Oppenheimer is now Invesco

As of March 31, 2024

-----------------------------------------

Best and worst St. Louis stocks of 2017

_______________________________________________________________________________________________

_______________________________________________________________________________________________

_______________________________________________________________________________________________

_______________________________________________________________________________________________

________________________________________________________________________

These 5 Vanguard

Index Funds Are All You Need

Originally published April 2015

If you’re not an investing hobbyist and you don’t employ an adviser, you simply

have no reason not to invest in index funds—funds that track broad market

indexes rather than try to beat them.

See My 2017 Picks:

6 Vanguard Index Funds to Buy and Hold Forever

But which index funds? Surprisingly, there’s little information about building a

diversified portfolio of good index funds and adjusting it as your goals change.

Standard & Poor’s 500-stock index is fine for tracking the performance of large

U.S. companies, but it’s not a complete portfolio.

This article will help you construct a simple but powerful package that also

includes bonds and stocks of small companies, as well as foreign stocks. It’s a

long-term buy-and-hold portfolio, so I deliberately didn’t fine-tune it to meet

current market conditions.

You would have had to be living in a cave the past year to miss the clamor over

index funds. Everyone from Warren Buffett to Dilbert has extolled their merits

lately.

I don’t believe, as some do, that index funds are the only

sensible way to invest. But they are a sound

method. Thanks primarily to their rock-bottom costs, index funds have

outperformed roughly two-thirds of actively managed funds across all kinds of

markets—and they’ll almost surely continue to do so. What’s more, picking the

one-third of funds that will beat their indexes is exceedingly difficult; many

argue that it’s impossible.

How to build an index portfolio? To start with, stick to Vanguard-sponsored

mutual funds and exchange-traded funds. Vanguard practically invented index

funds and has decades of experience running them—virtually without a hiccup.

Don’t kid yourself: It takes real expertise to manage an index fund well, which

means coming as close as humanly possible to matching the return of the

underlying index.

More importantly, Vanguard funds are frequently, though not always, the

cheapest. When you’re buying funds that seek to track broad market indexes,

there’s simply no excuse for overpaying due to high expenses.

The Vanguard cost advantage comes about because Vanguard isn’t a for-profit

company; it has no shareholders who want dividends. Blackrock or Schwab may

offer some funds or ETFs at slightly lower prices — but over time, I expect

those prices to rise.

Below are the only index funds or ETFs you need to achieve your goals. Choose

ETFs or conventional funds depending on what works best for you; if expenses are

equal, there should be essentially no difference in performance between a mutual

fund and an ETF that tracks the same index. All the indexes are weighted by

their holdings’ market values—in other words, the most popular securities get

much bigger weightings. For each fund, I list the symbol for the mutual fund

version first and then for the ETF. The mutual fund symbols are for Vanguard’s

admiral shares, which require a minimum investment of $10,000. You can buy into

Vanguard’s Investor share class for as little as $3,000, but you’ll pay a

slightly higher expense ratio for the privilege.

Vanguard Total Stock Market Index (symbols

VTSAX,

VTI) gets 40% of your

assets. This fund gives you the entire U.S. stock market—large, midsize and

small companies—for 0.05% annually. (That means you pay $5 a year for each

$10,000 invested to cover expenses.) The fund tracks the CRSP U.S. Total Market

Index, which includes some 3,800 stocks—making it much broader than the S&P 500.

Still, large companies dominate the index, and the fund’s return rarely deviates

from the S&P by more than one percentage point or so in any calendar year. Over

the past 10 years, the fund earned 8.6% annualized, an average of 0.6 percentage

point per year more than the S&P 500. (All returns are through March 31).

Put 10% of your portfolio’s assets into Vanguard Small-Cap Value Index (VSIAX,

VBR). It invests in many of

the stock market’s smallest, cheapest and least-popular companies by tracking

the CRSP U.S. Small Cap Value Index. There’s overwhelming academic evidence that

suggests that these stocks will outperform their more popular brethren over the

long term, as they have in the past. But you need patience here. Over the past

10 years, the fund returned 9.1% annualized. Expenses are 0.09% annually.

Vanguard FTSE All-World ex-U.S. Index (VFWAX, VEU) gives you the rest of the world’s bourses for 0.14% annually and deserves 20% of your assets. The fund tracks the FTSE All-World ex-U.S. index by investing in about 2,500 stocks from 44 countries. Roughly 20% of its assets are in emerging markets. U.S. stocks have trounced foreign stocks over the past five years, so it’s not surprising that the fund’s performance is anemic: an annualized 5.0%, or an average of 9.5 percentage points per year less than the S&P 500 over that period. But don’t count on U.S. stocks to continue to outpace the rest of the world’s. In investing, extrapolating the recent past into the indefinite future is a common and costly error.

Putting 5% into Vanguard Emerging Markets Stock Index (VEMAX,

VWO) brings your overall

investment in developing markets to 9% of assets when combined with the fund

above. Roughly half of the stocks in the FTSE Emerging Index, which the fund

tracks, are in China (25%), Taiwan (14%) and India (12%). Emerging markets have

been dismal performers over the past five years, which explains this fund’s

pathetic return over that period of 1.8% annualized. But emerging-markets stocks

are cheap, and the long-term argument for these fast-growing lands remains

strong. Expenses are 0.15% annually.

I suggest placing the final 25% of your assets in Vanguard Intermediate-Term

Corporate Bond Index (VICSX,

VCIT). The risk-adjusted

returns of intermediate bonds (that is, returns relative to volatility) have

historically been stronger than those of both long-term bonds and short-term

bonds. I prefer a corporate bond ETF over a total bond market ETF because the

latter holds too many Treasury bonds, which yield less than corporate IOUs.

Intermediate-Term Corporate Bond tracks Barclays Capital U.S. 5-10 Year

Corporate Bond Index, and the average credit rating of its holdings is triple-B.

The fund returned an annualized 6.8% over the past five years, but with bond yields so low, don’t expect such generous returns to continue. Expenses are 0.12%.

This portfolio should serve you well until you’re about 15 years from

retirement. At that point, I’d boost the bond fund’s allocation by five

percentage points—subtracting one percentage point or so from each stock fund.

Then add another five percentage points to your bond position every five years,

reducing your stock fund allocation in the same manner, until you have 40% in

bonds, a good bond weighting for the early years of retirement. Rebalance your

portfolio annually to bring the funds back in line with the desired allocation.

_________________________________________________________________

7 Good Energy Stocks for Your Retirement Portfolio

Retirement investors should be focusing on these steady energy stocks ...

because they're among the very few options you can actually depend on.

September 21, 2016

Retirement investors want sure things. There isn’t enough time to make up for

stocks that just fall into the ground, never to return. So considering how awful

energy has been for the past couple of years, it’s probably surprising to see

“energy stocks” and “retirement” mentioned in the same vicinity.

Sustained low oil and natural gas prices have negatively impacted energy stocks.

OK, that’s putting it mildly. Low prices have outright strangled some companies

right out of business, and has made life miserable for the vast majority of the

sector.

And considering many retirement investors were sucked in by the plentiful

dividends in the energy sector, they know the pain. And they’re probably not too

forgiving.

But those planning (or even in) retirement might be doing themselves a

disservice by avoiding energy stocks right now. There are a few — albeit not

many — that you can count on to get you through your golden years. They have

wide moats and huge asset bases, they can generate cash and they’re not shy

about giving some of it back.

As far as “sure things” go, these energy stocks are about as good as you can

get:

Exxon Mobil

Dividend Yield: 3.4%

A list of the best energy stocks for retirement has to begin with the kind of

them all: Exxon Mobil Corporation (XOM).

Exxon remains the powerhouse of integrated energy, and features tons of

everything you could want in a long-term energy play — reserves, assets, cash

flows, you name it.

On the production side of things, XOM continues to dive head-first into natural

gas production and shipping. The fuel promises to be one of the primary ways we

generate electricity in the future, and smart mega-buys — such as XTO and

InterOil Corporation (IOC)

— have made Exxon one of the world’s biggest players in nat gas.

Exxon isn’t going wholly overboard, though. Recent expansion projects have

boosted Exxon’s so-called “oil cut” (the amount of production that comes from

oil as opposed to natural gas and other sources) and balanced out liquids

production.

Of course, retirement investors should love Exxon because it can profit even

when neither energy source is doing well.

As an integrated giant, XOM has refining and petrochemical muscle. These

operations feast on lower energy prices and help balance out weakness in

production. That balance has actually saved Exxon’s skin over some of the past

few quarters, allowing Exxon to still make money amid commodity hiccups.

Exxon is energy safety personified. Throw in a secure 3%-plus dividend, and you

have as sure a thing as there is in the energy space.

Royal Dutch Shell

Dividend Yield: 7.3%

Great integrated energy stocks aren’t just limited to the United States. Europe

has its fair share, too, and for retirement investors, I like Royal Dutch Shell

plc (RDS.A,

RDS.B)

The downturn hit Shell hard despite its integrated nature. RDS shares lost more

than half their value between mid-2014 and their low point in January of this

year. Heck, shares still are off more than 35%.

However, Shell learned from its mistakes, and it’s righting the ship.

Shell was once known for high-flying projects and massive capital expenditures.

However, long-lasting low oil prices have forced Shell to trim cut the fat. RDS

has cut back on spending, canceled potentially never-profitable projects and

sold assets. Shell also has prioritized reducing its ballooning debt. That will

make Shell leaner and meaner.

Retirement investors should be encouraged that despite whispers that Shell might

cut into its dividend, it never did. Its generous payout has survived. And now

that RDS has new plans in place and smaller spending on deck, its dividend —

which yields more than 7%! — looks like the deal of the century for long-term

buy-and-holders.

In the end, Royal Dutch Shell is about as good an international play as you

could want.

Phillips 66

Dividend Yield: 4.1%

Refiners and downstream energy stocks have really gone to town as oil prices

have listed lower in a relatively tight range. Phillips 66 (PSX)

is among those winners.

Spun off from energy producer ConocoPhillips (COP)

a few years back, PSX has quickly become one of the downstream industry’s

biggest players. Refiners earn profits based on the difference between feed

stock costs (Think oil and natural gas prices) and the price for refined

products such as gasoline, jet fuel and heating oil. Those inputs remain low,

and

Phillips 66 is minting cash as a result.

As PSX has grown as a refining outfit, it has added midstream assets —

pipelines, terminals, rail lines and storage farms. Owning pipelines and

gathering systems is a great way to generate cash flows. Phillips enhanced that

by placing them inside of its master limited partnership, Phillip 66 Partners LP

(PSXP).

That way, PSX is preparing to keep its profits even when oil does inevitably

rise.

In short, Phillips 66 is balancing its portfolio so it can thrive through thick

or thin. That makes PSX a great play for the long haul.

Kinder Morgan

Dividend Yield: 2.2%

Kinder Morgan Inc. (KMI)

has 84,000 miles of pipeline under its midstream umbrella.

That’s a big number.

Kinder Morgan also boasts 180 terminals, fractionation and processing

facilities, coal depots, tankers and other pieces of infrastructure. Wrap it all

together, and you literally have the largest midstream firm in North America.

That’s why you buy KMI. That asset base and all the energy its touches is one of

the widest moats when it comes to energy stocks. Period.

In fairness, that wide moat hasn’t always paid off. Mighty Kinder Morgan has

stumbled on some major points in recent quarters, and amid the crash in oil and

natural gas prices, KMI was forced to cut its once lucrative and reliable payout

at the end of 2015.

Longtime investors will find that very difficult to forgive. However, that

dividend cut should be seen as a necessary and ultimately good thing. Certainly,

new money can’t complain about it. You see, the cut from 51 cents per share to

12.5 cents helped KMI shore up its balance sheet, clean house and get its cash

back up to snuff.

Kinder Morgan still is a work in progress, but its wide swath of midstream

assets will help it survive the current malaise. And when energy prices perk

back up, expect Kinder Morgan to start sweetening the income deal once more.

Schlumberger

Dividend Yield: 2.5%

Energy demand can ebb and flow, but over the long-term, the direction is north.

And whether you’re drilling for natural gas or crude oil, onshore or off, it

takes a lot of technical know how to tap the power of the mighty hydrocarbon.

That’s why Schlumberger Limited (SLB)

is a winning play for retirement.

Schlumberger provides the equipment necessary for companies to find and drill

for energy sources. That includes things such as seismic services, well

completions, drilling equipment and pressure pumping. Schlumberger makes it

much, much easier to drill for oil, and that’s a powerful position to be in.

But what really differentiates SLB from rivals such as Halliburton Company (HAL)

is its client list.

Instead of focusing on North America, Schlumberger has a global portfolio, and

thus its revenues are … well, “worldlier.” That’s important, because state-owned

energy firms can have a different mandate than publicly traded energy stocks.

They often drill despite losses. Plus, the multitude of operating regions means

some could be profitable, covering for when others are not.

Schlumberger can be profitable during some pretty lean times. This isn’t a major

income play, but SLB provides decent dividends with the ability to provide

market-beating returns when oil roars back.

Duke Energy

Dividend Yield: 4.2%

Technically speaking, the utility sector is not the same thing as the energy

sector.

You can take that difference up with your local sector fund provider. Because to

me, if I’m thinking about stocks that deal with energy, utilities come to mind,

and they absolutely have a place in any retirement portfolio.

Utilities are the steady Eddies of the investment universe. They’re not bonds,

but for stocks, they’re awfully reliable. That’s because no matter what the

economic environment looks like, we still need to heat our homes and keep the

lights on.

Duke Energy Corp. (DUK),

the largest generator of electricity in the nation, is awfully steady.

DUK has more than 7.4 million customers located in hotbeds of growth, and it

boasts a generating capacity of 52,697 megawatts. The firm also provides natural

gas distribution in many of its main service areas, so Duke is a double threat

in that way. Cold winter? Nat gas provides more oomph. Hot summer? Electricity

demand spikes.

Duke also recently has expanded on its natural gas efforts, and will add

numerous more natural gas customers when its buy-out of Piedmont Natural Gas

Company, Inc. (PNY)

goes through.

And as for its generation fleet, DUK has taken rising regulation head-on. Duke

has been closing coal plants and has been adopting solar and wind energy. Duke

already owns 500 MW worth of solar capacity and has long-term power purchase

contracts for another 1,300 MW. Duke just made agreements with more than 30

solar developers to add up to 3,300 additional megawatts.

Duke can keep providing energy long into the future, and its predictable profits

will continue powering a predictably generous dividend.

iShares U.S. Energy ETF

Dividend Yield: 3.4%

As we said when we started this, retirement investing is about finding sure

things. Well, while the stocks on this list are pretty good, catastrophes can

and do happen.

Thus, perhaps the most guaranteed lock in energy is to never bet on one single

energy company. Instead, put your money into a collection of them, via an

exchange-traded fund such as the iShares U.S. Energy ETF (IYE).

IYE provides investors with access to nearly 80 North American energy stocks

with one single buy order. That’s instant diversification across different parts

of the energy “stream,” mostly focused across the sector’s large-cap stocks.

Naturally, IYE holds a couple of bad eggs, but most of the firms in this fund

have survived the duress as well as can be expected.

The nice thing about IYE is that if one or two energy stocks collapse, you don’t

lose your whole investment. The ETF will suffer, sure … but it won’t suddenly

disappear, and it will bounce back when the sector writ large recovers.

This fund also features a very generous (for a plain equity ETF) dividend of

about 3.4% currently. Meanwhile, expenses are moderate at 0.44%, or $44 annually

per $10,000 invested.

Read more at

http://investorplace.com/2016/09/7-energy-stocks-to-buy-retirement/view-all/#.V9MkrfkrJ9N#LtQUFSjAklvSEGDX.99