Corporations

http://www.bizfilings.com/wizard.aspx

http://www.bizfilings.com/comparison.aspx

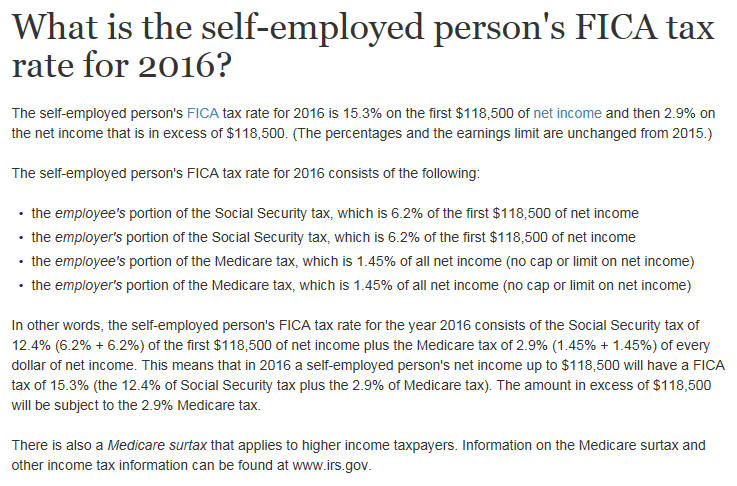

Defining the

Benefits

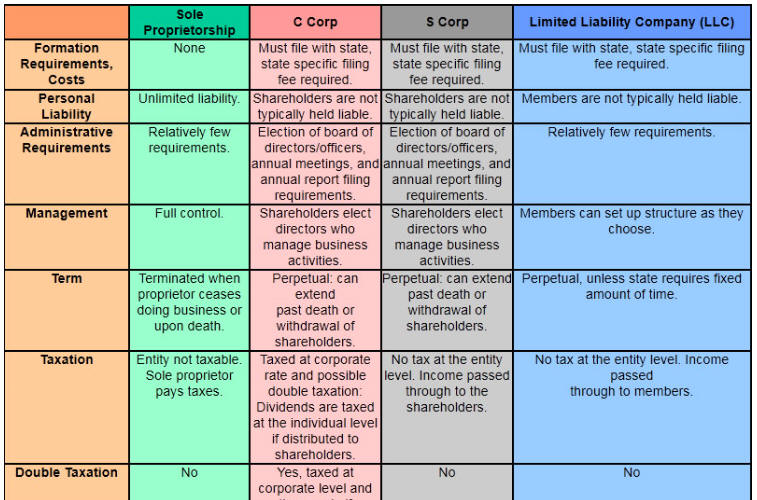

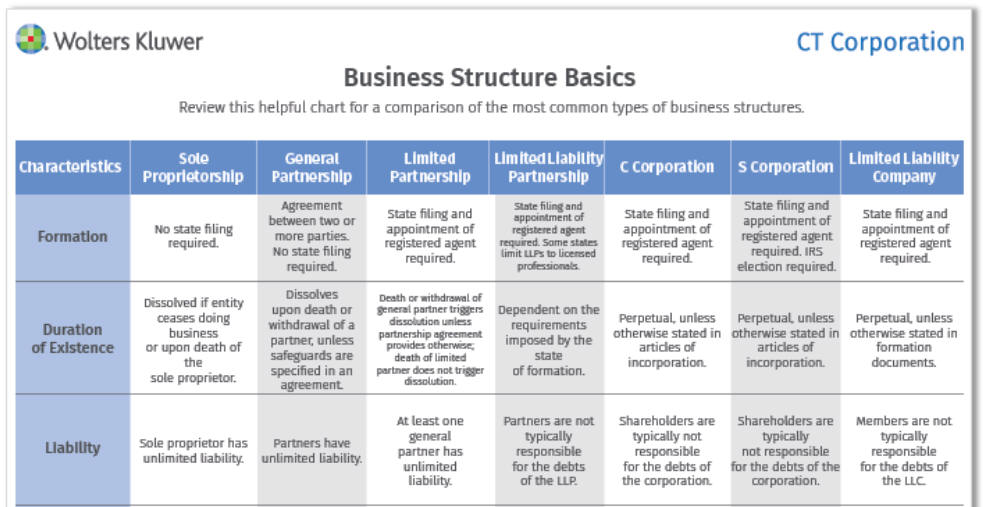

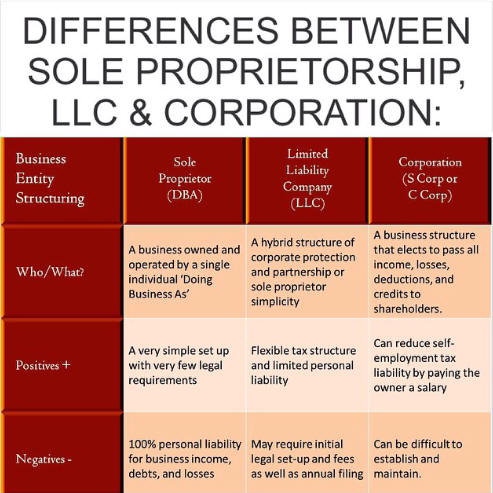

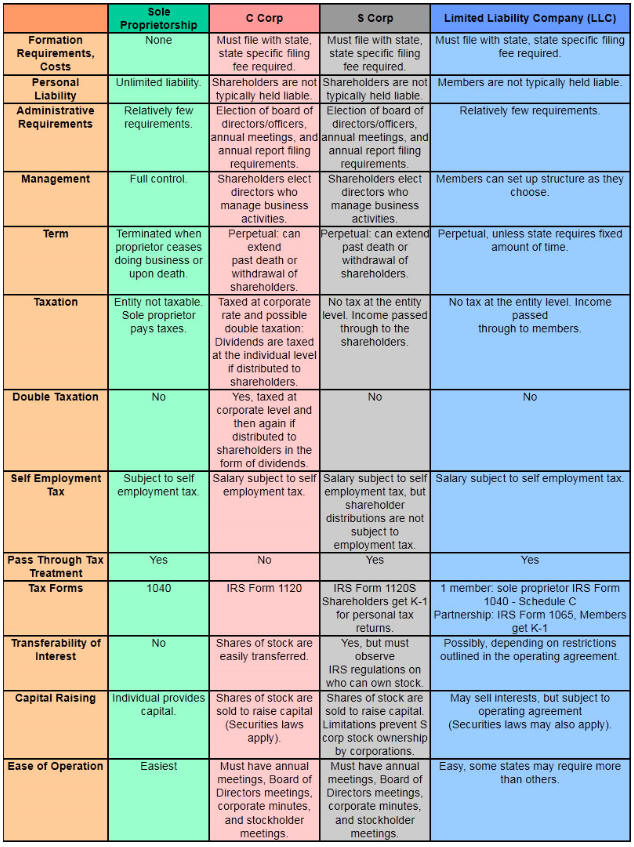

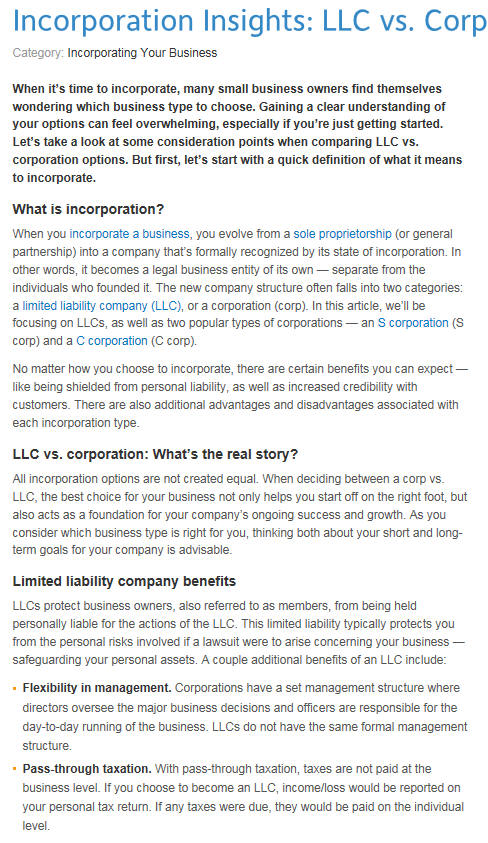

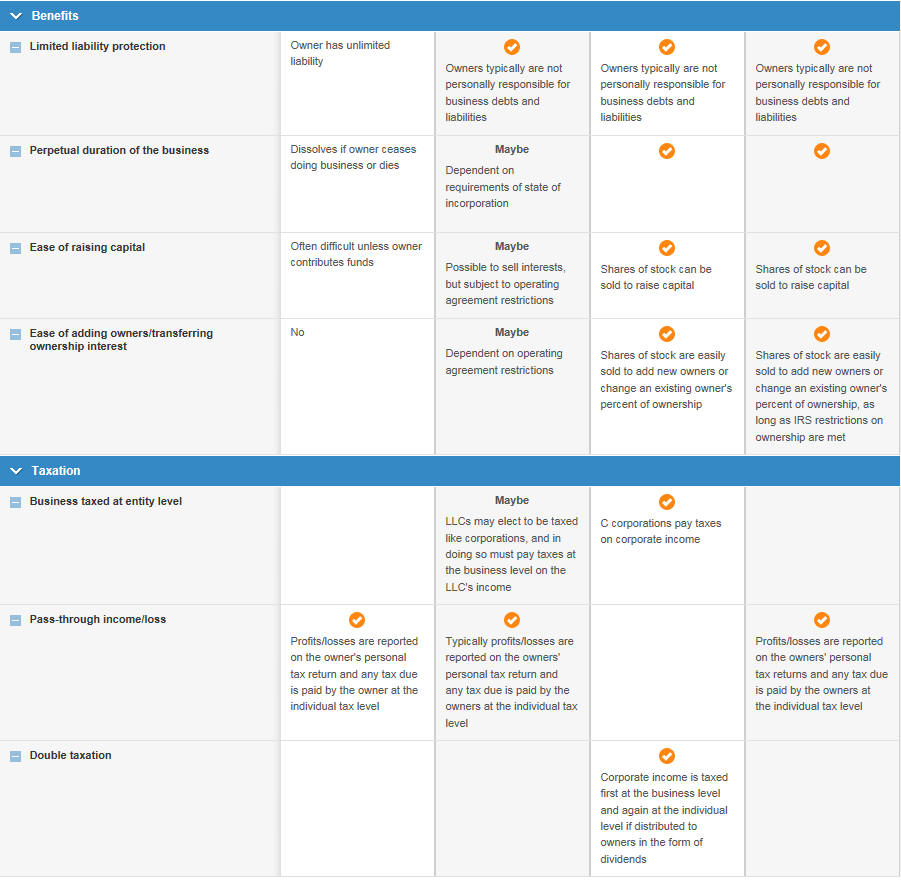

A major advantage of organizing your business as an LLC or an S corp is that you

can protect your personal assets from the creditors of your business. "Limited

liability means you can't be financially responsible for more than your

investment in the company," writes Greg McFarlane in his book,

Control Your

Cash: Making Money Make Sense.

"If you put in $10,000, and incur $11,000 in debt, you're only potentially

liable for $10,000. Your creditors (check that, your LLC's creditors) can't

'pierce the corporate veil,' as the phrase goes."

Another common aspect of LLCs and S corps is that they help you avoid paying

both personal and corporate taxes. The difference is that in an S corp, owners

pay themselves salaries plus receive dividends from any additional profits the

corporation may earn, while an LLC is a "pass-through entity," which means that

all the income and expenses from the business get reported on the LLC operator's

personal income tax return, says Ebong Eka, a CPA who also pens his own blog

about the world of entrepreneurship at

MoneyMentoringMinutes.com.

Both LLCs and S corps can also deduct pre-tax expenses, such as travel,

uniforms, computers, phone bills, advertising, promotion, gifts, car expenses,

and health care premiums, McFarlane writes.

Dig Deeper:

Choosing Between an LLC and a Corporation

Note the Differences

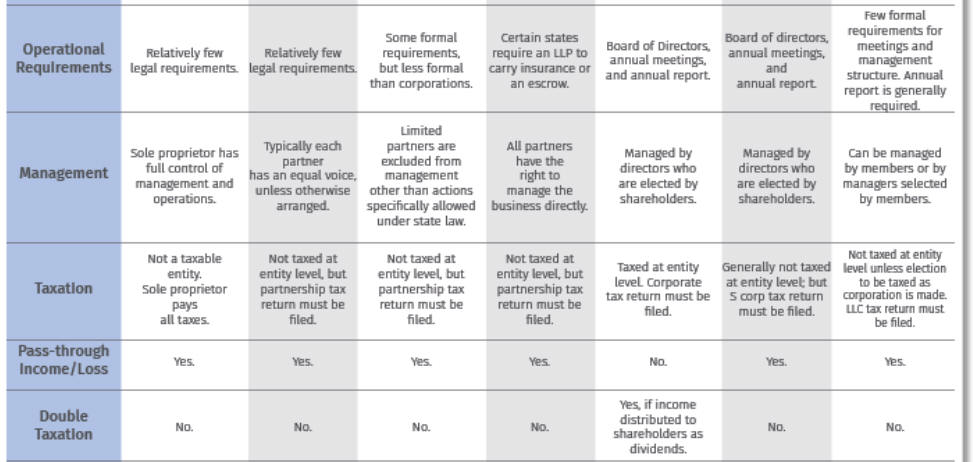

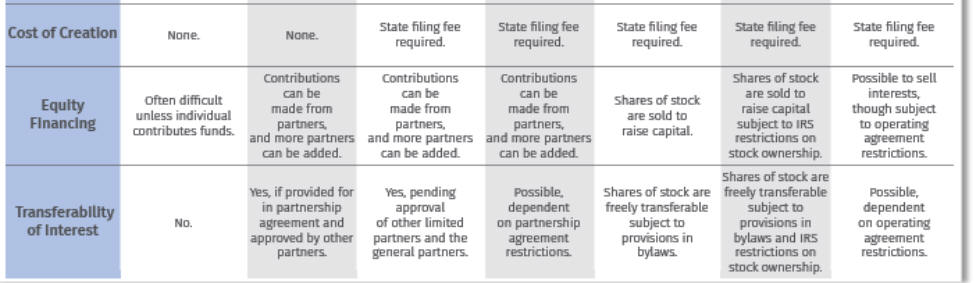

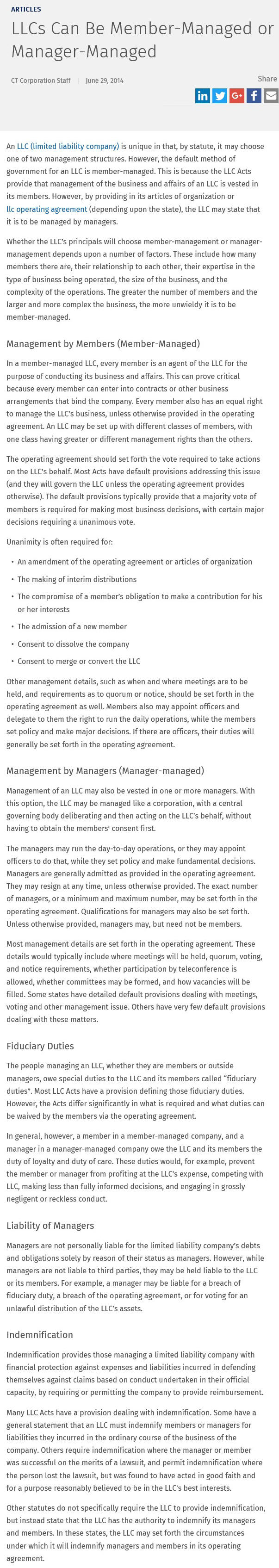

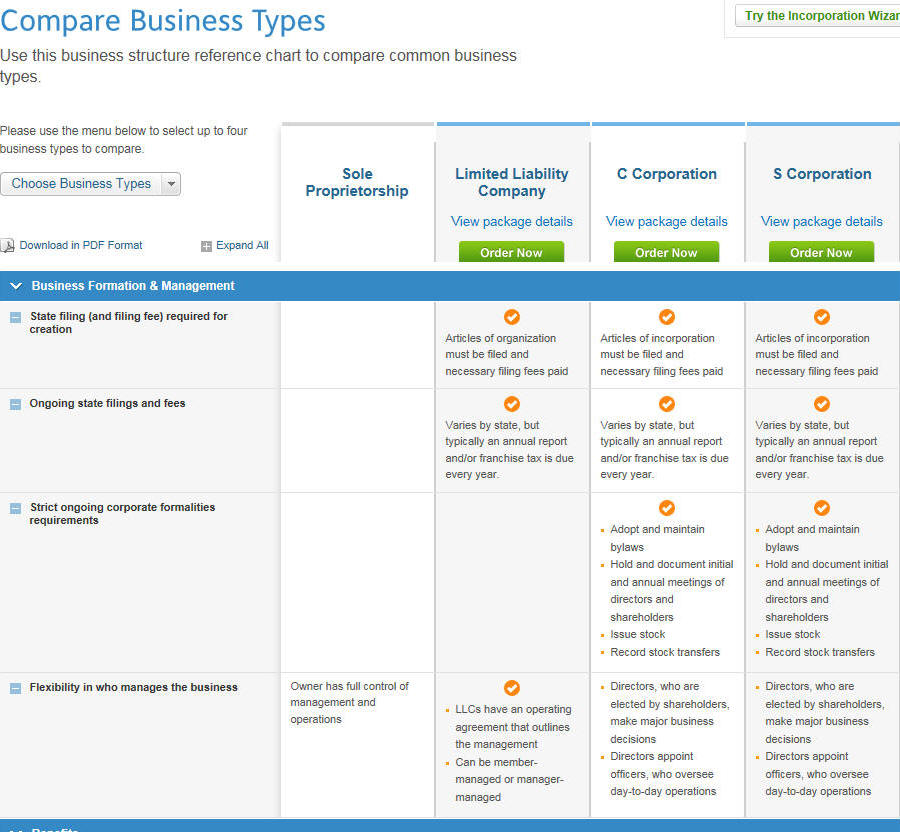

Once you understand the benefits that come from LLCs and S corps, it's time to

explore some of the pros and cons of each approach. Here are some of the key

differences, according to Eka:

LLC Pros:

The owner of a single member LLC doesn't have to file a tax return for the LLC,

as they only report the activity on their personal tax return.

Ease of setup: Most LLC forms are only a single page for single member LLCs.

Inexpensive to start: The cost of setting up an LLC is also inexpensive, usually

just a couple hundred dollars.

Guidelines: The red tape involved in forming an LLC isn't as stringent as that

involved with S corps, which also leads to savings on accountant and attorney

fees, among others.

LLC Cons:

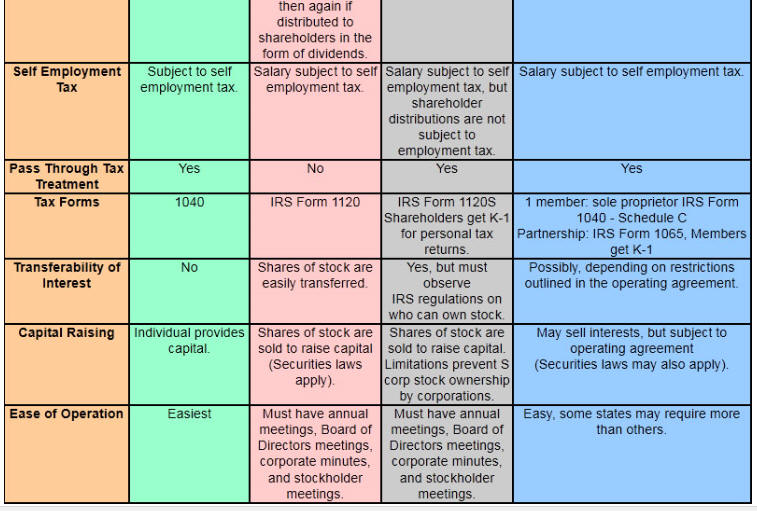

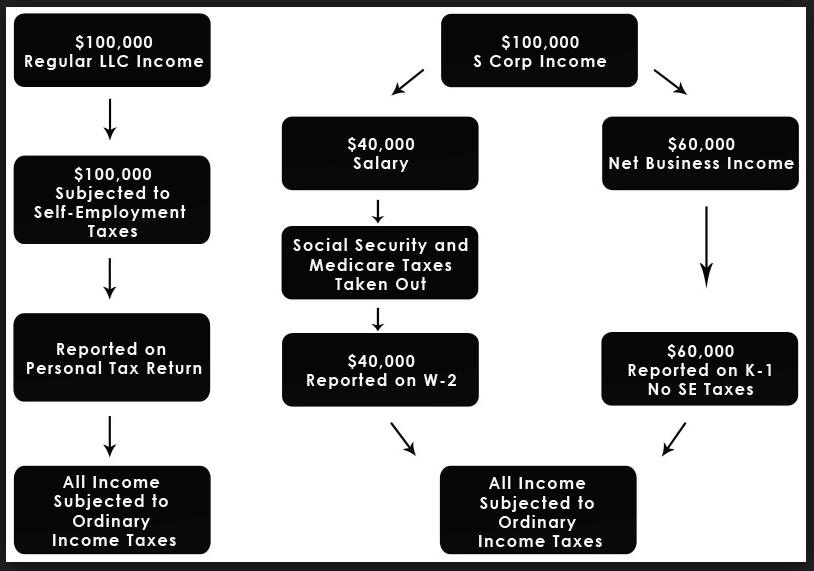

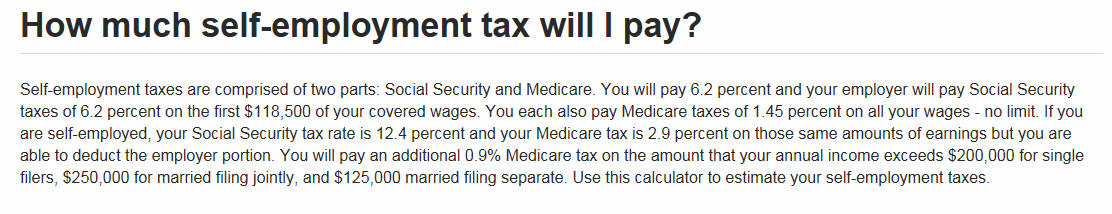

Self-employment tax: Single member LLC owners are required to pay

self-employment tax on income generated in the LLC, which means making quarterly

estimated payments to the IRS.

Owners of LLCs must make sure they don't pierce the "corporate veil," meaning

they have to operate the LLC separately from their personal affairs. "The LLC

must not be a shell but an operating entity," says Eka. "There have been cases

where a business owner lost their protection because there was no distinct

difference between the LLC and its owner."

Dig Deeper:

What Is an LLC?

S Corp Pros:

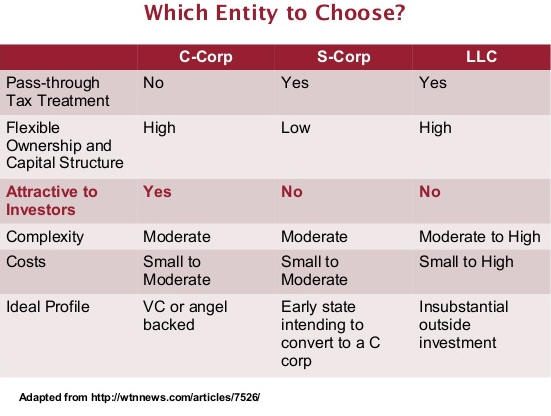

The key advantage of an S corp is that it offers tax benefits when it comes to

excess profits, known as distributions. The S corp pays its employees a

"reasonable" salary, which means it should be tied to industry norms, while also

deducting payroll expenses like federal taxes and FICA. Then, any remaining

profits from the company can be distributed to the owners as dividends, which

are taxed at a lower rate than income.

S Corp Cons:

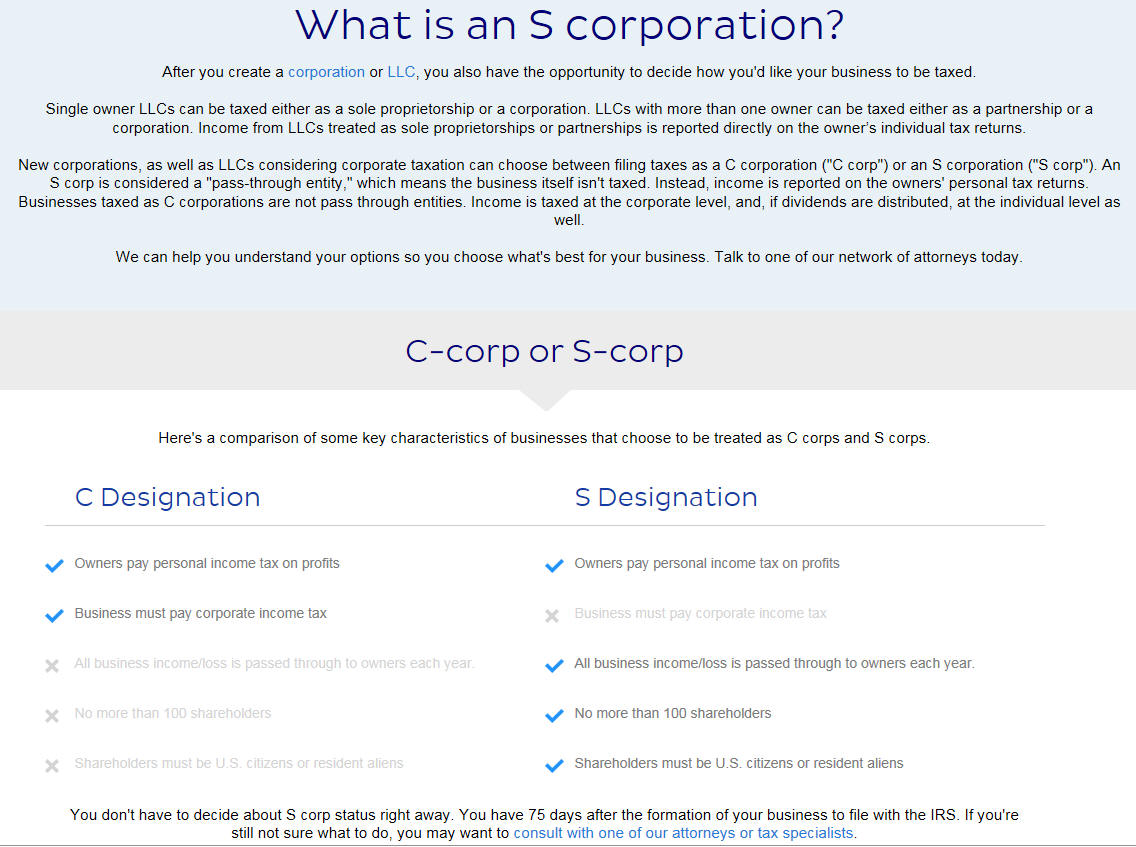

S corps have more strict guidelines than LLCs. Per the tax code, Eka says, you

must meet the following standards to create an S corp:

Must be a U.S. citizen or resident.

Cannot have more than 100 shareholders (a spouse is considered a separate

shareholder for the purpose of this rule).

Corporation can only have one class of stock.

Profits and losses must be distributed to the shareholders in proportion to the

shareholder's interest. For example, you can't have disproportionate

distributions of dividends or losses. If a shareholder owns 10 percent of the S

corp, he or she must receive 10 percent of the profits or losses.

It costs more to form an S corp.

Shareholders must adhere to the requirements at all times. If they don't, they

risk disallowing the S corp election, and the corporation would be treated as a

C corp with its corresponding restrictions.

Passive income limitation: You can't have more than 25 percent of gross receipts

from passive activities, such as real estate investment.

There can be additional state taxes for S corps.

Shareholders should pay attention to paying themselves a "reasonable" salary for

the work they perform for the S corp, since the IRS is increasingly scrutinizing

S corps for this.

Dig Deeper:

What Is an S Corporation?

Case Study: Why an LLC Might Be Best for Your Business

Given that it takes far less red tape to organize and is generally cheaper to

administer, the LLC might be your best choice if you're a new business owner or

operate an internet business, says Eka.

There is also another key benefit of LLCs: You can elect to be taxed as an S

corp while retaining the structure of an LLC. Consider the case of Mike Turner,

founder of Front Street Brokers, a real estate agency in Boise, Idaho. When he

started his business, which sells high-end homes and properties, he was advised

to form it as an LLC, which he did. However, a couple years later, as the

business began to earn more revenue, Turner was shocked by the amount of taxes

he was paying the IRS.

It was then that his accountant told him how he could elect to be taxed like an

S corp while keeping his LLC intact. Turner decided to make the switch. He began

paying himself and his wife a modest salary, which he also pays fees on (such as

FICA and unemployment insurance), and then paying himself a monthly dividend

from the extra profits his company was earning.

"The rules are I must pay myself a realistic salary," says Turner. "I can't pay

myself minimum wage, and do the rest in dividends. But in my industry, the

average salary is not that high, so I can still take a hefty amount via the

dividends." The difference has been a savings of between $6,000 and $8,000 a

year in federal taxes. "I feel I get the best of both worlds," he says. "For my

small business, I get all the legal benefits of running my small business

through an LLC, but I can be taxed as an S corp, which saves me money at tax

time."

Dig Deeper:

Choosing the Limited Liability Company as Your Corporate Form

Case Study: Why an S Corp Might Be the Better Choice

While Turner's story is a compelling one for a smaller, lifestyle business, the

truth is that fast-growing businesses that plan to bring on investors or share

the ownership of the company with employees may need to consider making the

switch to an S corp sooner rather than later.

Consider the case of Vicky Phillips, the founder of

GetEducated.com,

which provides guides and ratings for college courses and programs offered

online. Phillips originally started her business, which is based in Burlington,

Vermont, as an LLC and has kept it that way for 10 years. But now that her

business is established--it now earns $1 million in annual revenue--she's ready

to bring on investors to expand even faster.

In talking to her advisers, she came to realize that it was in her best interest

to convert her company into an S corp, despite some of the disadvantages of

doing so. "There's much more paperwork required to substantiate everything," she

says, since running an S corp requires you to hold meetings, keep minutes, make

resolutions, elect officers, and produce formal financial statements. "But the S

corp structure creates more separation between me and the company, which is

something that investors and bankers are more comfortable with."

Phillips says that she spent about $6,000 on attorney and accountant fees making

the switch over from an LLC, the assets of which were essentially bought by the

new S corp, though she admits she could have spent less if she had been willing

to do more of the paperwork herself. "I'm not a huge fan of more paperwork,

which is one of the key reasons we held off on making the switch for as long as

we did," she says.

__________________________________________________________

Protect Your Ideas – Top Ways To Guard Your Intellectual Property

With the ever-increasing ease in which information can spread, it is becoming

harder to secure your intellectual property or product ideas and ensure they are

not unfairly recreated or produced by someone else. Whether you are a small

start-up or a multinational organisation, taking steps to protect your

intellectual property should be a priority within your business.

What exactly is intellectual property?

The term intellectual property is commonly used, however many people are unsure

of its exact meaning. Put simply, it is any product, idea or work that resulted

from creative thought. Examples include manuscripts, designs, inventions,

business names or confidential information.

If you come up with a great idea, design or product, you want to make sure that

no one else has the right to take that product and claim it as their own.

Intellectual property is protected and governed by various national and

international laws, depending on where the idea was created, what the idea is

and many other determining factors.

Steps to secure your intellectual property

There are a number of key steps you can take to protect your business and its

products and ideas. By following these basic rules suggested by

Prime

Lawyers,

you will be less likely to face issues with intellectual property theft and be

adequately covered should a problem arise.

Register your idea

Contact a patent or intellectual property attorney and register your idea. It is

important that the exact and minute details of your product are written down and

registered to distinguish it from any similar ideas. It is also important to

consider where your product may end up in the future and if there are any

overseas laws or regulations that you need to consider.

Don’t talk about it

Before you have had the chance to adequately secure your intellectual property,

avoiding discussing your idea. Be careful who you trust with this vital

information and do not promote your idea in any sort of public forum. Until you

have officially secured your intellectual property, anyone can take your idea

and create it for themselves.

If you are working in a partnership, it is recommended that you speak with an

attorney and sign non-disclosure agreements.

Record your idea in detail

Ensuring you have detailed drawings, descriptions, plans and general records

that can prove you have been working on your idea will help if anyone challenges

intellectual property ownership. Ensure the information is dated to show when

you were working on the idea.

Apply for a trademark

Once you have a business name and logo for your idea, register an original

trademark. A memorable trademark will help you stand out from any competitors

and can help in promotion of your product in the future. You should also use the

correct copyright symbols on all documentation and development of your product.

This will further enhance your ownership of your idea.

Get a patent

Patents can be purchased to cover a wide variety of physical products ideas and

designs. While they can cost up to $200,000, if your idea is truly

groundbreaking, it can be a very good investment for the future of the product.

Make the investment

Securing your intellectual property rights can be costly and time consuming,

however putting in the effort now may pay off significantly if any issues arise

in the future.